Photo: Collected

According to current provisions of Vietnamese law, goods that are moveable assets and belongings of Vietnamese people residing abroad when repatriated to their home country are not subject to value added tax and are not subject to value added tax.

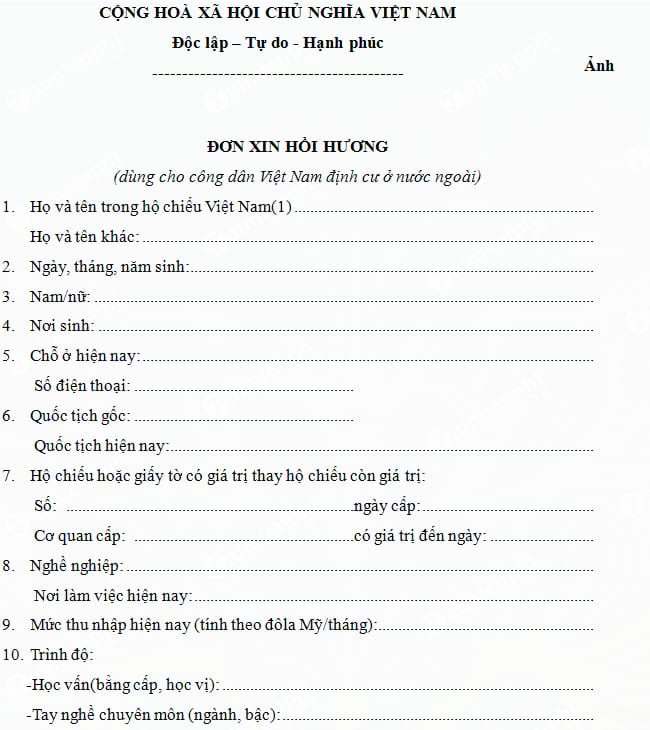

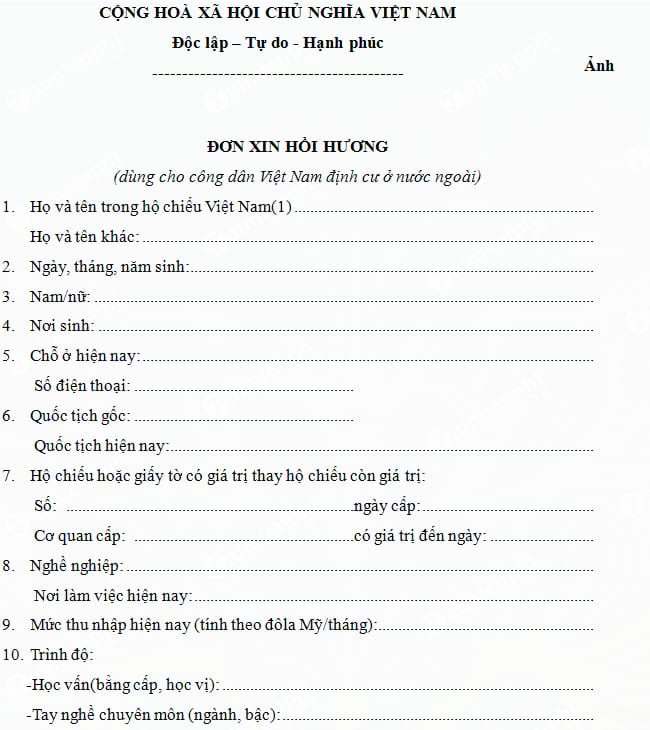

Repatriation Application form using in Vietnam (Source: Collected)

Repatriation Application form using in Vietnam (Source: Collected)

Exemption from import tax, specifically:

- For the amount of assets and income that overseas Vietnamese bring with them when repatriating to Vietnam, there is no limit in quantity and is not subject to any taxes.

- For consumer goods such as cars, motorbikes, televisions, refrigerators, air conditioners, and used stereos, one unit per household (or individual) is exempted from import tax. Vietnamese residing abroad bring it back home when allowed to settle in Vietnam.

- According to current regulations of the Law on Special Consumption Tax, goods that are movable assets brought back by individuals and families of Vietnamese residing abroad when repatriated are not subject to consideration for exemption from special consumption tax. special. Currently, items subject to special consumption tax are cigarettes, alcohol, beer, cars, and gasoline.

[...]

Rights and obligations of overseas Vietnamese when repatriating:

- Notified by the authorities that repatriation has been resolved. This document is valid for 12 months. If the expatriate does not return after the above deadline, it will be considered invalid, then if you want to be repatriated, you will have to go through the procedure again. from the beginning.

- Pay the repatriation fee of 100 USD/person/time.

- You can bring foreign currency and assets back to Vietnam without having to pay import tax (for cars, each household is only exempt from import tax for one passenger car with 12 seats or less and other assets, only for items, Goods subject to special consumption tax are not exempt from tax).

- When returning to Vietnam within 30 days from the date of entry, you must complete the procedure to register permanent residence at the sponsor's address, and apply for an ID card.

- Overseas Vietnamese who have been repatriated and registered for permanent residence in Vietnam enjoy all the rights and are responsible for performing all obligations like Vietnamese citizens permanently residing in the country.

- In case repatriated overseas Vietnamese have foreign passports, Vietnamese authorities will not confiscate and do not carry out any procedures on that passport.

Source: Thu Vien Phap Luat

Repatriation Application form using in Vietnam (Source: Collected)

Repatriation Application form using in Vietnam (Source: Collected)